" alt="Asian markets swing as traders prepare for US jobs data" width="2560" height="1707" data-lazy-srcset="https://business.inquirer.net/files/2024/09/South-Korea-Financial-Markets-5-scaled.jpg 2560w, https://business.inquirer.net/files/2024/09/So...

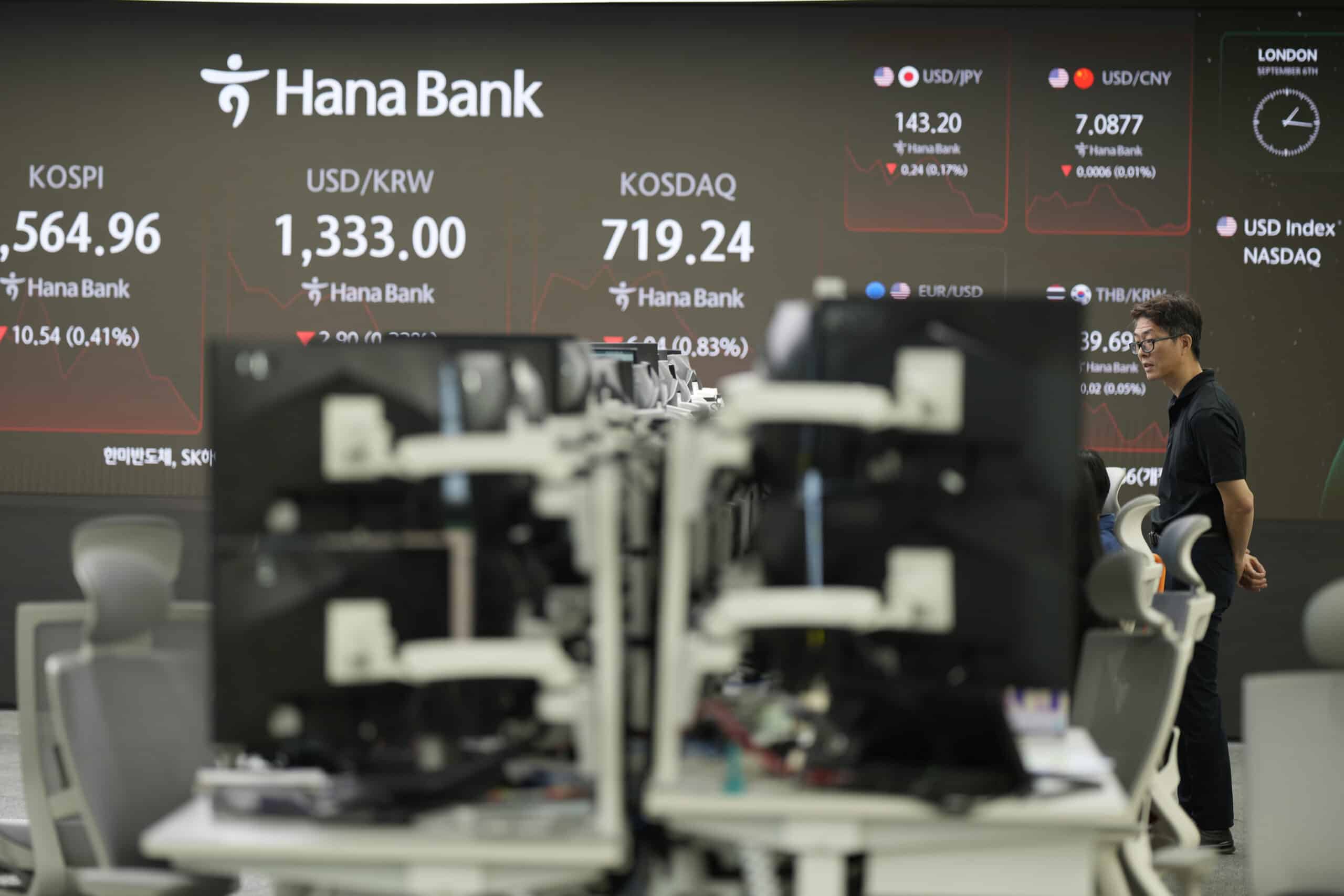

A currency trader stands near the screens showing the Korea Composite Stock Price Index (KOSPI), the foreign exchange rate between U.S. dollar and South Korean won and the Korean Securities Dealers Automated Quotations (KOSDAQ), at a foreign exchange dealing room in Seoul, South Korea, Friday, Sept. 6, 2024. (AP Photo/Lee Jin-man)

Hong Kong, China — Asian markets drifted Friday as traders positioned themselves ahead of a highly anticipated US jobs report later in the day and following a mixed bag of economic data on the world’s top economy.

As a rollercoaster week drew to a close, debate centred on the Federal Reserve’s plans for interest rates when it meets in less than a fortnight, with most observers expecting a 25-basis-point cut.

Article continues after this advertisementHowever, analysts say it could go twice as big if the non-farm payrolls report for August comes in well below forecasts as a series of recent figures suggest the economy is slowing more sharply than initially thought.

FEATURED STORIES BUSINESS National ID gives more Filipinos ‘face value BUSINESS BIZ BUZZ: Unwinding Gogoro … quietly BUSINESS Polvoron maker seeks P500 million capital for expansionREAD: Stocks struggle as US data keeps traders wary

A big miss in July’s reading fanned fears of a recession and was a key driver of the rout across markets at the start of last month.

Article continues after this advertisementInvestors were given a slight jolt by data Thursday showing a miss on private-sector hiring, which was slightly offset by a dip in first-time and continuing claims for jobless benefits.

Article continues after this advertisementA separate report pointed to a marginal increase in activity in the key services sector, which beat expectations.

Article continues after this advertisement“There has been nothing in the latest batch of US economic data… to materially impact on expectations for (Friday’s) all-important employment data or to move the dial on expectations for what the Fed is likely to do on September 18,” said National Australia Bank’s Ray Attrill.

Wall Street ended the day on a tepid note, and Asian investors were equally cautious.

Article continues after this advertisementShanghai, Sydney, Singapore, Taipei, and Jakarta rose, while Tokyo, Seoul, Manila, and Wellington fell.

READ: Benign inflation report perks up shares

The calm end to the week came after markets were sent tanking Wednesday following a disappointing read on factory activity and worries about tech firms’ valuations — particularly chip giant Nvidia — after a rally this year.

Analysts warned that there was a lot of risk in Friday’s jobs figures, with a sharp drop likely to boost bets on a 50-point cut but stoking fresh recession worries, while an above-forecast read denting hopes for a series of cuts this year.

Traders have factored in one percentage point-worth of reductions before the end of the year.

“One thing is becoming increasingly evident: the more the market leans into the idea of a 50 basis point cut, the shakier equities get,” said Stephen Innes in his Dark Side Of The Boom newsletter.

“This week’s relentless market slide is a reflection of mounting fears that a 50 basis point cut isn’t a soft cushion but rather a red flag signalling turbulent economic waters ahead.”

Key figures around 0230 GMTTokyo – Nikkei 225: DOWN 0.2 percent at 36,568.05 (break)

Shanghai – Composite: UP 0.3 percent at 2,797.09

Hong Kong – Hang Seng Index: Closed for typhoon

Dollar/yen: DOWN at 143.21 yen from 143.42 yen on Thursday

Euro/dollar: UP at $1.1114 from $1.1110

Pound/dollar: DOWN at $1.3178 from $1.3180

Euro/pound: UP at 84.34 pence from 84.29 pence

West Texas Intermediate: UP 0.2 percent at $69.27 per barrel

Brent North Sea Crude: UP 0.2 percent at $72.81 per barrel

New York – Dow: DOWN 0.5 percent at 40,755.75 (close)

Subscribe to our daily newsletter

London – FTSE 100: DOWN 0.3 at 8highway,241.71 (close)

READ NEXT Natural gas bill to show PH welcomes investors, Senate told Oil power UAE completes Arab world’s first nuclear plant EDITORS' PICK Party-list system: What to know ahead of 2025 polls LIVE UPDATES: Tropical Storm Kristine NBA: Nuggets give Aaron Gordon 4-year, $133M extension VP Sara Duterte says she still sees Sen. Marcos as a 'friend' UPDATES: 2025 elections precampaign stories Sandro Marcos calls out VP Sara Duterte: ‘You crossed the line’ MOST READ SC issues TRO vs Comelec resolution on dismissed public officials Tropical Storm Kristine slightly intensifies; Signal No. 2 in 5 areas LIVE UPDATES: Tropical Storm Kristine Espenido retracts drug-related allegations vs De Lima View comments